Support at Home and Funding Reforms – It’s Finally Here! - November Newsletter

- Kate Helmore

- Nov 3, 2025

- 6 min read

Updated: Dec 8, 2025

For those in the industry and probably those already engaged with aged care services, Support at Home and the changes to residential care feels like it’s been coming forever! Initially planned to roll out on 1 July 2025, it was pushed back to give providers (and the Government) more time to iron out the finer details of the reforms.

I have done a few previous newsletters on this topic back in October 2024 and May 2025, however we know a little more about the reforms now and exactly how it impacts consumers. I thought it would be helpful to put together a refresher on exactly what you can expect to change from 1 November 2025.

For this reason, the theme I’ve chosen for November is

“Support at Home and Funding Reforms – It’s Finally Here!”

There are fairly major changes happening across in-home aged care and residential care from 1 November 2025. What is currently known as ‘Home Care Packages’ will now be a new program called ‘Support at Home’ and the contributions consumers pay towards residential care will be changing.

Most importantly, if you were receiving services through a Home Care Package (HCP) prior to 12 September 2024 or a permanent resident in residential care prior to 1 November 2025, nothing changes for you.

CHANGES TO HOME CARE

The main changes to home care are:

- Increased funding levels

- No more care management and package management fees

- Services separated into three support categories

- Increased contributions from consumers

INCREASED FUNDING LEVELS

Support at Home offers additional funding levels with eight classifications:

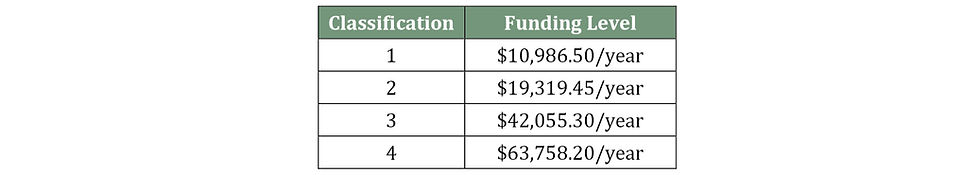

This is compared to an existing four funding levels under the Home Care Package programme:

There is also additional funding available for ‘short-term pathways’. The three short-term service classifications are:

- Restorative Care Pathway - $6,000 (12 weeks) additional care, can be increased to $12,000 if eligible.

- End-of-Life Pathway - $25,000 (12 weeks).

- Assistive Technology and Home Modifications (AT-HM) Scheme $500 for low needs, $2,000 for medium and $15,000 for high.

The AT-HM funding is especially helpful as the money is available upfront for consumers to use. Previously you would need to save funds to be able to purchase equipment, but now this can be done more proactive if eligible.

CARE MANAGEMENT AND PACKAGE MANAGEMENT FEES

Providers are no longer charging this as a separate item and have been instructed to include these costs within their hourly rates. For example, an Adelaide based provider previously charged $87.00/hr for personal care (e.g. showering & dressing) + fortnightly package management fees (varied depending on level of package). Under Support at Home pricing, they will now charge $119.00/hr for the same service, however consumers are no longer paying fortnightly for care & package management fees.

SERVICE CATEGORIES

Under the new Support at Home programme services will be classified into three categories:

- Clinical Care: includes all nursing and allied health services e.g. OT, podiatry, speech pathology, exercise classes.

- Independence: personal care, in-home respite, social support, transport, bus trips, day programs and massage.

- Everyday Living: shopping assistance, house cleaning, garden maintenance, meal preparation, home maintenance and laundry services.

There are different contribution rates for each of these categories, as outlined below:

1. Grand-fathered HCP clients -

receiving HCP services prior to 12 September 2024.

These clients will continue with their current level of funding and contributions. There is no change.

2. Transitioning clients -

approved for or began receiving services between 12 September 2024 and 1 November 2025.

Transitioning clients who were approved or began receiving services after 12 September 2024 will transition to the Support at Home model with a capped contribution of 25%.

3. New Support at Home clients -

approved for or began receiving services after 1 November 2025.

New Support at Home clients will have contributions determined by Services Australia with a maximum of an 80% contribution on some services for fully self-funded retirees. Services Australia will use your current income & asset data to determine your fees. If you do not feel Services Australia have your most up-to-date information, it is important to update this.

CHANGES TO RESIDENTIAL CARE

The main changes coming through in residential care settings are:

Changes to daily payments and means-tested contributions for new entrants.

The retention of a small portion of refundable accommodation deposits (RAD’s) - 2% per year, for up to 5 years

DAILY PAYMENTS AND MEANS-TESTED CONTRIBUTIONS

There are two types of residential care fees – accommodation cost and daily care fees.

The accommodation cost is the advertised room price, which can be paid by a Refundable Accommodation Deposit (RAD), Daily Accommodation Payment (DAP) or a RAD/DAP combination. In Adelaide rooms can vary from $150,000 for a shared room with a shared ensuite far from the city to $1,300,000 for a brand new, 32m2 apartment style suite in North Adelaide.

1. Refundable Accommodation Deposit (RAD) - this is when you pay the full amount yourself. The amount is refundable, so will be given back to the individual or their estate when they leave the facility.

2. Daily Accommodation Payment (DAP) - this is a more ‘rental’ style model, which is calculated by applying the maximum permissible interest rate (MPIR) to your agreed room price and dividing the amount by 365.

3. RAD/DAP Combination - this involves paying a lump-sum towards the room cost to reduce your daily payments.

OLD STRUCTURE

On top of the accommodation cost, you also previously had three daily care fees which were separated into three categories:

1. Basic Daily Fee - this is set at 85% of the daily pension and is currently $65.55/day for every resident in every facility.

2. Means Tested Care Fee - this varies depending on the individual's income & assets. This is confirmed once a Services Australia assessment is completed.

3. Additional Services Fee - this varies from facility to facility and covers things like bus trips, meal options, glass of wine, streaming channels etc. It was previously compulsory and could vary from around $5-50/day.

NEW STRUCTURE

For people entering care after 1 November 2025, the accommodation payment methods will remain the same (more about RAD retention in a minute …). However, there are some changes to the daily care fees.

1. Basic Daily Fee – this remains the same as present, set at 85% of the daily pension, currently $65.55/day.

2. Hotelling Contribution – a new means-tested fee that covers catering, cleaning & gardening. Up to a maximum of $22.15/day.

3. Non-Clinical Care Contribution (NCCC) - new means-tested fee that covers bathing, mobility assistance & lifestyle activities. Up to a daily cap of $105.30 with a lifetime cap of $135,318.69 or after 4 years. Fees paid under Support at Home also count toward the lifetime cap.

4. Higher Everyday Living Fee – an optional fee for residents who want additional services e.g. glass of wine, streaming services, meal options etc. It is the new ‘Additional Services Fee’, but importantly is not compulsory. This will vary from facility to facility and will be offered once you enter respite or permanent care.

If you’ve made it this far, congrats! This is a lot of complex information and whilst I’ve tried my best to simplify I know it can still be quite overwhelming! I promise we’re almost done…

RETENTION OF RAD

For anyone entering permanent care after 1 November 2025, facilities can now retain 2% of the RAD per year, for up to 5 years after the initial RAD is paid (maximum of 10% retention). This retention amount is calculated daily and cannot be deducted more than once per month. Any amounts deducted from the balance, including retention amounts, will reduce the balance on which subsequent retention amounts are calculated.

For example, if a resident goes into care on 1 December 2025, is a full fee paying accommodation resident and pays the $500,000 RAD upfront their fees will work as follows:

December 2025 retention amount:

$500,000 x 2%/365 x 31 = $849.32

RAD balance after retention:

$500.000 - $849.32 = $499,150.68

January 2026 retention amount:

$499,150.68 x 2%/365 x 31 = $847.87

RAD balance after retention:

$499,150.68 - $847.87 = $498,302.81

If you’ve read all of this and are still feeling like it’s a whole wild world of fees and acronyms, you’re not alone. The aged care system is incredibly complex and very hard to navigate. Even for people like myself that work in the space everyday, we’re working overtime to get our head around the changes and see how they actually work in practice.

If you’re in any doubt, please feel free to get in touch. Now is a great time to link in with aged care financial advisors and aged care consultants like myself to start mapping out how these changes may impact you and how they will affect you financially.

As always, please feel free to pass this newsletter on to friends or family. If they want to subscribe, they can do so via my website.

If you want to have a look through some old podcast episodes, you can search for ‘The Truth About Ageing’. I release episodes sporadically which are available through your favourite podcast app (Apple Podcasts, Spotify) or at

Occasionally I also post updates on socials, which you can find at:

Facebook - @navigateagedcareau

Instagram - @thetruthaboutageing

Big love,

Kate.

I appreciate the clarity of this discussion. The role of interactive digital services in enhancing accessibility is a key point. Additional background on this topic may be found on the website . The article provides a balanced view of the challenges and opportunities.